Insiders Insights: Join Today and RECEIVE a FREE one hour consultation To JuMp Start Your Portfolio!

Create Your Future: Obtain Generational Financial Security with The Morgan Report

GREETINGS: David Morgan here. This will be the most important message you read in a long time. Discover how we can supercharge your portfolio with a free one hour consultation with me.

From the visionary behind the soon-to-be-released documentary "SILVER SUNRISE" and the author of "The Silver Manifesto and Second Chance," it is your turn to learn the simple approach to building legacy financial security for you and yours from the founder of the Morgan Report.

We Can Help You Can Create Your Future And Obtain Generational Financial Security with The Morgan Report

David Morgan has studied monetary history and the collapse of Empires for most of his life. Mr. Morgan cautioned the world about the monetary and social breakdown that is bringing anxiety to so many people. Unfortunately, this trend will continue and accelerate.

A strong financial base can provide you and yours with peace of mind. The way to financial security is based upon certain principles that you will learn.

Generational wealth is achieved by investments that last throughout the human experience from generation to generation. There are only three asset classes that have achieved this for thousands of years. Three- Gold, land, and fine art.

Gold preserves wealth over the long term. Land is the basis of all wealth, it can be from the earth- mining, farming, or improved land for living or manufacturing. Fine art is a separate category and fits into the collectible category. This takes some expertise but has been proven to both build and protect wealth generation to generation. So there you have it, not much else to discuss, correct?

In a general way this is actually all you NEED to know from a macro perspective, but applied knowledge is true power and therefore we are willing to investigate further ways to increase your returns in real terms and to mitigate your risk as much as possible.

Since gold is the ultimate money and the fact that money is required to function in any society regardless of political structure we are assured that gold is a backbone of building and keeping wealth for generations.

The problem for those independent enough to understand the adage that “he who owns the gold, makes the rules” means that the banks own most of the gold and therefore make the rules regarding gold. At times gold can literally be a lifesaver and at other times gold is illegal to own. It is worth mentioning that gold should be held even during times of being banned and there are ways to do this legally. The elites always leave themselves a way out and all you need to do is find the loophole and do what “they” do. In fact this was addressed in a video update for our premium members recently.

Silver still provides greater upside than gold because it is required for a technology based society. The constantly increasing demand for silver suggests a natural “corner” of the silver market is as soon as 2030. This is based upon several assumptions and cannot be guaranteed.

The main problem with silver is that it is not considered the money of last resort like gold. For all practical purposes no central banks hold silver as a monetary asset. If silver were considered silver by the banking system and the gold/silver ratio was set at the monetary ratio of 16:1 we would quickly learn how scarce the silver market is compared to gold. With the banks holding 3 billion ounces of gold it would require sixteen times as much silver to have the cover ratio, which means 48 billion ounces of silver. The amount of investment silver is about five billion ounces at present.

We Have Drifted Away From Sound Money

To illustrate how far the United States has drifted from the principle of sound money (a silver standard) we only need to think of the following.

The amount of workers in the U.S. is 160 million. The average wage is $27.50 per hour. The price of silver currently is about the same as an hourly wage. So eight ounces of silver represents a day worth of work.

For the U. S. this means 1.3 billion ounces of silver would be required to cover- ONE DAY'S WAGES IN THE UNITED STATES. This is 30% more than the total annual silver supply of the world counting both mining and recycling.

I have often thought if all investors were as knowledgeable as you, and we had the population pay themselves once a year in silver, what would that do to the price of silver? This is merely a thought experiment but something like this will take place soon.

Because there is 5 Trillion “dollars’ sitting on the sidelines right now waiting for a place to seek refuge from the uncertainty in the financial system. One percent of this is 5 billion dollars which is two years of silver supply. If you believe what we believe, which means currency will seek safety as all other investments start to adjust to the new reality that the government has tried to print their way out of this quagmire and it has not worked. The run to gold and silver as safe havens has begun. People world wide seeking legacy wealth, and protection will push these metals into new high prices.

This is already true in many countries but most reading this crucial update only think of the metals in US dollar terms.

The Run To Gold Has Already Begun

Cycle of Success: Leveraging the Three Phases of Market Movement

Markets move in three phases. We have had two legs up in the gold and silver markets with one left. The silver market went from $5 to $21 and pulled back to under $9 in the financial crisis of 2008. From there the silver market rallied to nearly $50 in May 2011. The low for the last move is in, silver hit $12 in March of 2020 just when Covid hit the mainstream. All that is left is for the last piece of this incredible puzzle to fit into place. The final leg UP is huge in price appreciation and once started accelerates rapidly, leaving many that were waiting for the big move left behind.

For example, in that last major bull market silver went from $6 in January of 1979 to $50 in January of 1980. A gain of 850%.. The current market can be expected to do at least as well because we will be in a worldwide panic out of stocks, bonds, real estate, currencies, and life insurance and into one asset class- precious metals. We may see oil and energy stocks move wildly as well.

When every investment is being sold for whatever the market price will bring and ALL of those proceeds chasing into a market that represents only one percent of the total financial system the move in percentage terms will be monumental. This suggests a move in silver from the twelve dollar low of March 2020 to $100 minimum. Two hundred is more likely as markets overshoot during frenzies and this will be a market that will set records in so many ways.

The governments of the world may try and stop the run to gold but nothing can hold this back. Further, the BRICS nations are likely to add to the buying pressure by adding to their gold holdings while the West may try and discourage gold buying only to watch their scheme backfire.

If You're Thinking That Having Precious Metals In Your Portfolio Is Not Important, You're Going To Miss The BIGGEST MOVE In History...

Golden Opportunities: Capitalizing on the Run to Gold

The governments of the world may try and stop the run to gold but nothing can hold this back. Further, the BRICS nations are likely to add to the buying pressure by adding to their gold holdings while the West may try and discourage gold buying only to watch their scheme backfire.

The Great Gold & Silver Rush – is ahead of us and most have given up that are aware of the above facts. It is both sad and disheartening to know that facts and yet the most precious and best assets to own during severe monetary instability are underperforming. Many very smart people have given up and are convinced that the bankers and financiers will be able to control prices within certain parameters with their delta hedging and paper contract parameters. These markets will be controlled forever.

History provides a different lesson as all manipulations in the past have come to an end. Some argue there is no manipulation and I go into depth in the book the Silver Manifesto that provides proof that there is no random walk on price of silver!

Silver and gold are undervalued relative to the oil, housing, and the dow. If we factor in the money supply growth both the metals could be five to ten fold higher. If the market overshoots to the upside which is often the case in monetary panics then we cannot rule out gold over $10,000 USD for example. Before we get there we need to see $3000 gold and how market sentiment changes.

If we look at the mining shares the story borders on unreal. Almost all silver miners are mining at a loss or are just above break even. Lows like this in any market sector is rare and the opportunity is so great that investors tend to overlook the fact this is the time when generational wealth will be built by those willing to look foolish buying into a sector that is so unloved.

The truth is the industry has gotten greedy since the illness began in March 2020 and many precious metals investors have been totally ripped off by large premiums that were not necessary. Further, many of these well known retail dealers do NOT have the deep pockets needed to sell massive metals positions if there is a large amount of selling at the top. That is not the case with my preferred network.

From $100,000 to $59,100: The Shrinking Value of Your Savings

The purchasing value of the dollar is eroding with each tick of the clock. This means you’re spending $150 today for what cost you $100 in 2011. And all this occurred with an "average annual inflation rate" of only 2.8%. Now, we face an annual rate of 5.4%. This could mean you lose another 41% of your money's buying power over the next decade. Your hard-earned savings of $100,000 could dwindle down to the purchasing power of just $59,100.

However, there are proactive measures you can take to not only safeguard but also grow your wealth in the face of rising inflation.

As you have witnessed, the Federal Reserve's policy of printing money to stimulate economic growth has long-term consequences. The massive $11 trillion spending since the onset of the COVID-19 pandemic is a vivid example. The U.S. Senate has now suspended the debt ceiling, adding even more spending. These decisions will inevitably speed up the inflation rate. So you could lose a lot more to "inflation"!

The U.S. Dollar’s Era Is Fast Coming To An End...

WILL DIGITAL CURRENCIES SAVE US?

No, Crypto's Are Not Going To Save You... So You Better Have Have A Backup Plan

Many of you have rushed into Bitcoin and other cryptocurrencies despite our warnings. How did that work out for you?

The rules of investing seem simple: diversify your portfolio and focus on the long term. That’s until you see some guy on YouTube get rich overnight betting on cryptocurrency.

Imagine a scenario where unidentified hackers silently infiltrate your bank account. Rather than draining it all at once, they siphon off small percentages over time. Would you notice before it was too late?

If you listen to mainstream media, they want you to believe the inflation rate is only 6%, but that's not the full picture. Not by a long shot. They have you looking at the incorrect metric. The real measure of inflation is determined by the reduced buying power of your dollar today as compared to its value in previous years.

Your money's purchasing power has decreased by a shocking 50% or more over the last decade. Don't believe me? In 2011 the average home price was just $118,000. Today, that same home costs $436,000. That is a 269.58% increase. That is a lot more than the reported inflation.

The scenario may sound far-fetched, but it's happening to you right now. In fact, it's happening to you every day, not through hackers but through the subtle eroding force known as inflation.

But don't go betting the farm just yet! While millions pour into the cryptocurrency space, the number of actual wallets getting fatter is just a small handful. In fact, over 98% of the wallets are valued at just under $300. So who's getting rich?

The price of Bitcoin and other cryptocurrencies plunged amid a crash in digital assets that has wiped away $900 billion in market capitalization in just a few days. Terra Luna, a so-called "stable coin", went from a high of $120.00 to $0.001113 in just a few days. The price of the Terra (LUNA) cryptocurrency fell more than 99.9%, wiping out the fortunes of crypto investors. Terra was ranked among the top 10 most valuable cryptocurrencies. This crash wiped out more wealth than both the 2000 internet bubble and the 2008 great financial crisis. Did you see this coming?

Setting that aside... maintaining your strategic asset allocation are among the most important ingredients in your long-term investment success. And during uncertain times it's best to pour some of your investments into safer havens.

Are you putting your faith in crypto currency and the stock markets?

Many investors are risking money in these overpriced financial assets. Your money is even further exposed to risk in banks where depositors and bondholders can be subjected to bank bail-in legislation.

Having said all that... Bitcoin Is Not Going To Save You!

Precious Metals Are A Protection of Wealth

Gold and Silver are Safe-Haven money that fits the legacy wealth guarantee you want for yourself and generations to come. Land of course works long term as well but we are cautious currently and can discuss during your consultation if you wish.

Throughout history, gold and silver have proven to be consistently reliable assets. In contrast, every form of fiat currency has eventually lost its value. Similarly, stock markets have downturns, and entire economies have collapsed, but gold and silver have endured.

Be truthful-How well has your portfolio performed over the past 20 years? Have you been raking in profits that are equal to or better than what gold has done? If you're like most investors your stock portfolio has not gone up 465% like gold has! Most likely inflation has eaten away at your profits over the last 20 years. The S&P 5000 was at 1,112 in 2003 and now is up 385% so this index has done well, but NOT as well as gold! And almost all mutual funds or general stock pickers do not do as well as the S&P. The point is to become a legendary investor you not only need gold you need conviction.

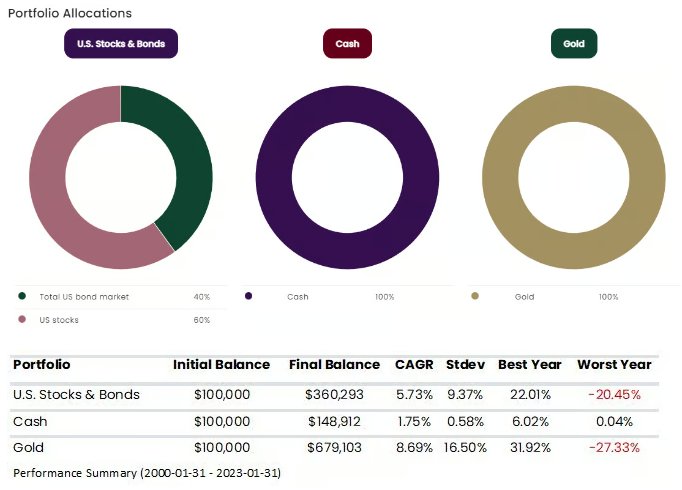

To help you get a better understanding of how different investments have performed over the last two decades, we've set up three different portfolio scenarios. And we're going to be looking specifically at how gold stacked up against other options.

We tracked these portfolios from January 2000 to January 2023, so you can see how they performed over a long period of time. And let me tell you, the results are pretty eye-opening.

As you will see, in the last 20+ years, Gold outperforms cash and a 60/40 stock & bond portfolio by almost double.

How did your retirement account perform?

Fortify Your Wealth: Gold and Silver's Unwavering Safe Haven Status

In a world where economic uncertainties and market volatilities reign, there's an extraordinary opportunity that stands out—offering you the chance to not only build wealth but also safeguard what you already possess.

Consider for a moment the investments that have consistently outperformed others, regardless of market conditions. Imagine having assets that not only grow your wealth but also shield it from the unpredictable twists and turns of the financial world. That's the remarkable potential of gold and silver.

Why Gold and Silver Are the Ultimate Investments:

Preservation of Wealth: While fiat currencies are susceptible to inflation and devaluation, gold and silver have proven to maintain their value over time. These metals act as a safeguard against economic fluctuations, providing you with a lasting store of wealth.

Diversification: Building a diverse portfolio is crucial to managing risk. Gold and silver offer a unique opportunity to diversify your holdings beyond traditional assets like stocks and bonds. Their low correlation with other investments can help shield your portfolio from unexpected downturns.

Hedge Against Uncertainty: Geopolitical tensions, economic downturns, and currency crises are part of our world. During times of uncertainty, gold and silver shine even brighter, offering you a safe haven to weather the storm.

Tangible Assets: In an increasingly digital world, there's immense value in owning physical assets. Gold and silver provide you with something you can hold in your hand, independent of financial institutions and electronic systems.

The Morgan Report is an exclusive membership-based publication that provides in-depth analysis and expert insight into the global economy and the financial markets. We have connections with industry insiders you will not receive anywhere else period. These relationships have been obtained over decades in all aspects of the investment industry. From Investment Bankers to private equity. These are global in nature. For example we will connect you with a bullion/coin dealer that in many instances will save you so much on your next precious metals purchase that you too will send us a Thank You Note.

Our proven strategy is your way to maximize the move

of this historic bull market in precious metals.

I urge you not to invest in another stock until you understand what's really going on behind the scenes… and how YOU can profit from it.

This Economy Is Going To Break

The economy is not going to recover from the psychological and financial impacts of Federal Reserve policies. Right now, the U.S. Government is being bailed out by the banking system using YOUR tax dollars and borrowing the rest from future generations. What happens when the Federal Reserve says to the Federal Government of the US corporation that your credit limit ha been hit, you cannot borrow anymore?

As a result of our endless money printing follies, other countries are starting to dump the dollar and inflation is running away from us.

America's day of reckoning is here and the run to Gold has already begun.

The Time To Act Is Right Now!

We will have another economic disaster... Will you be sitting on the sidelines like everyone else watching it all happen... or will you already be enjoying the benefits of the greatest move in history?

NOTHING is left to Chance When Making Recommendations for You!

You don't want to be the investor who invests money anticipating a capital gain without fully understanding the risk reward profile. But with the meticulous hands-on research I do for you, and the no-nonsense assessments I draw for you, you can position yourself to minimize risk and maximize profit by investing in carefully chosen stocks poised to benefit from the rise of hard assets.

It is this hands-on approach that separates your Morgan Report membership from other Publications. Your membership assures you will earn a spot in the most selective inner circle of trusted sources for physical purchases, top tier, mid tier and the speculative sector.

The past two decades have witnessed gold's rise, surging by 500 percent. Gold boasting returns of 10 percent in 2023 alone. Amid amplified financial stress and macro uncertainties, gold's allure as a safe haven has surged.

The winds of change are upon us, and the waves of transformation are unstoppable. Your membership will provide insights which illuminate a path forward, leading to a world where gold and silver stand tall, defying uncertainty and safeguarding your wealth. The journey beckons, and your choice of investment will shape the legacy you leave behind.

I personally vouch for the fact that each information-packed issue of my newsletter will help you safeguard your money and grow your nest-egg, even in these uncertain economic times.

Remember, investing in gold and silver opportunities isn't just an opportunity; it's a strategic move towards stability and prosperity. Join the ranks of savvy investors who recognize the power of precious metals in a world of market volatility.

The time is NOW! These resource companies have never represented such value. Buying silver at fifty cents an ounce in the ground is rare, but in today’s world where investors chase any shiny object other than the metals you are making a move that is contrary to the actual herd instinct. It's time to get started! Click the button below and schedule your one on one call or video, learn all you can about investing, the metals, mining, money, financial collapse and retirement. We have never made an offer this generous before. We have never seen a market at a more advantageous buying area for brave investors before. . Start building a financial future that will become a legacy with investments in gold, silver, royalty companies, uranium, and a few asymmetrical trades using blockchain.

There are three kinds of people in the world.

- Those that make things happen

- Those that watch things happen

- Those that wonder what the heck happened

Don't be a bystander to this financial revolution. Embrace the future, seize the opportunity, and ride the golden waves of change. Subscribe today and stay tuned for more insight

Future-Proof Your Wealth Today!

Sign up for the Morgan Report and get your one-on-one call with David Morgan and learn the best and most cost effective way to buy and sell precious metals. Ask YOUR questions that will be of most interest to your goals, be them financial, privacy, safe retirement or whatever pressing questions you need to have answered. We cannot give tax advice or comment on an individual stock but other than that any topic is open.

On a risk to reward basis alone this is the best offer you have probably ever seen. Because you are getting a $1,000 consultation that is yours to keep whether you retain your premium membership or not. You now know that once this market takes off you will receive my buy signal and not be left on the sidelines waiting for the pullback that never happens. The last phase of the bull market shakes off many people, they simply watch the market run away from them.

This is the one part of a major secular market where you can “get rich quick” because the market keeps moving up, almost straight up and it happens quickly. Investors in this sector have been largely disappointed for more than ten years- 2011-2023. Don’t be left behind when the market dynamics completely change and we witness large moves almost daily and the market peaks within 19 months you will want the Morgan Report for guidance.

We at the Morgan Report have had a relationship with you in the past and wish to build a better and stronger relationship with you now. According to our records you were a member of TMR in the past. There is a possibility you are still a member and we need to update our records to reflect your current information.

JOIN THE MORGAN REPORT PREMIUM OR MASTERMIND MEMBERSHIP TODAY: You will receive a $1,000 consultation as my thank you for having been a member in the past. Once you sign up we will schedule your call, and I will provide you with a one hour call or video call - your choice. (* This offer is not available on Basic Memberships)

The minute you join, you will gain full access to the members only portal. If you decide after the one on one call with David Morgan that the Morgan Report is not for you – don't panic. You are still protected by a 30 day money back guarantee and can stop the report and still have the benefit of our one on one call.

There is only one aspect of the call I want to take control of and that involves whom I suggest you use to buy and sell precious metals. Our premium members know this name and I want to make sure you have access to this information. Many of our members have paid for their subscriptions for years due to the money they have saved by using our number one precious metals dealer.

Wishing you health above wealth, wisdom beyond knowledge

David Morgan

Discover Why Over 100,000 People Have Subscribed To Our Insiders Insights With The Morgan Report

Here are a few of our membership benefits:

THE

MODEL PORTFOLIO

You See Every Trade I Make

Ask Me Anything

David Morgan

Be the first to hear of new discoveries

I've dedicated The Past 25 Years Developing A Publication That's Tailored To Help Everyday Investors - Like You - Survive & Thrive During Any Economic Situation

Our proven strategy is your ticket to riding the wave of this historic bull market in precious metals and achieving significant returns.

I urge you not to invest in another stock until you understand what's really going on behind the scenes… and how YOU can profit from it.

The economy is not going to recover from the psychological and financial impacts of Federal Reserves policies. Right now, the U.S. Government is bailing out the banking system using YOUR tax dollars.

As a result of our endless money printing follies, other countries are starting to dump the dollar and inflation is running away from us.

America's day of reckoning is here!

You need to position yourself for thriving during economic downturns and be on the right side of the "War on Your Money"!

We are not your average "how to recession-proof your portfolio" newsletter. This is about making some serious gains in the midst of chaos and uncertainty. We're talking about seizing the greatest investment opportunity of a generation and coming out on top.

Sure, the global markets may be in turmoil right now, but that just means there's plenty of money to be made for those who know where to look. And that's where I come in. My investment strategy is all about taking advantage of market conditions.

Dive Into The Morgan Report: Discover Why 100,000+ People Have Become Informed, Awake & Aware!

Let My Passion Create Your Wealth

I've Been Helping My Subscribers Weather This Economic Mess For Years... Now It's Time For You To Get The Same Insights

What really happens during a major collapse is that the wealth changes hands. You will actually benefit by looking ahead and knowing exactly how to build and preserve your wealth.

Premium and Mastermind services is The Morgan Report's highest level of memberships. And that means you are getting the best we have to offer.

We will time the markets as best we can. We'll get you in as close to the bottom as possible and get you out as close to the top as possible.

We consider TMR members to be family. So we provide our members with the best we have to offer.

Preserving the authenticity and close-knit nature of our group is a priority for both myself and the current members of the Morgan Report.

I hope you’ll take advantage of this opportunity now and claim your one hour free consultation to supercharge your portfolio today!

Step 1: First, login in here

Step 2: Log in using your current username:

Step 3: Click the Sigh Up or Renew Membership button

Step 4: Choose your membership

Step 5: Continue To Payment

Once you complete your membership, we will send you details on how to setup your free consultation.

You are fully protected by our

No Risk Money Back Guarantee

We Take The Risk For You!

We are dedicated to ensuring that you derive immense benefits from our offerings, having crafted them specifically to deliver on this promise.

Your contentment is our priority.

However, should our services not meet your expectations, a quick, single-sentence email to support@themorganreport.com within 30 days of acquiring your membership is all it takes, and we will promptly process your refund.

It’s that easy, straightforward and hassle-free.

Upholding integrity is paramount for us, which is precisely why our refund policy is so robust and uncompromising.

© 2025 by The Morgan Report